Coronavirus: Americans, Are You Okay?

Affected by the outbreak of the coronavirus epidemic, the US economy has suffered a double hits from the public health crisis and the economic crisis. The number of confirmed cases of the novel coronavirus in the United States has exceeded 7 million, and the death toll has exceeded 200,000.

The economic crisis triggered by the epidemic is also unprecedented and affected supply, demand and finance. Since the outbreak of the epidemic in February, six months have passed, and the epidemic is still not ending. The coming Autumn and Winter will be the season of flu outbreaks. The flu and the novel coronavirus epidemic will make the rhythm worse.

Americans, how are you guys? The Brookings Institution interpreted the impact of the novel coronavirus epidemic on the US economy and American lives through ten dimensions.

1: Small business income has fallen by more than 20%

The novel coronavirus epidemic has caused particularly severe damage to small businesses. Small businesses are not only the mainstay of the US economy, but also employ nearly half of the workforce in the private sector.

- Disposable Medical Face Masks with Elastic Ear Loop 3 Ply Breathable and Comfortable

- Disposal Protective Clothing for Medical Use

- N95/KN95 Protective Mask with Elastic Ear Loop

- Surgical Mask with Elastic Ear Loop 3 Ply Breathable and Comfortable

- ZeroVirus Space Portable Sterilization Bar

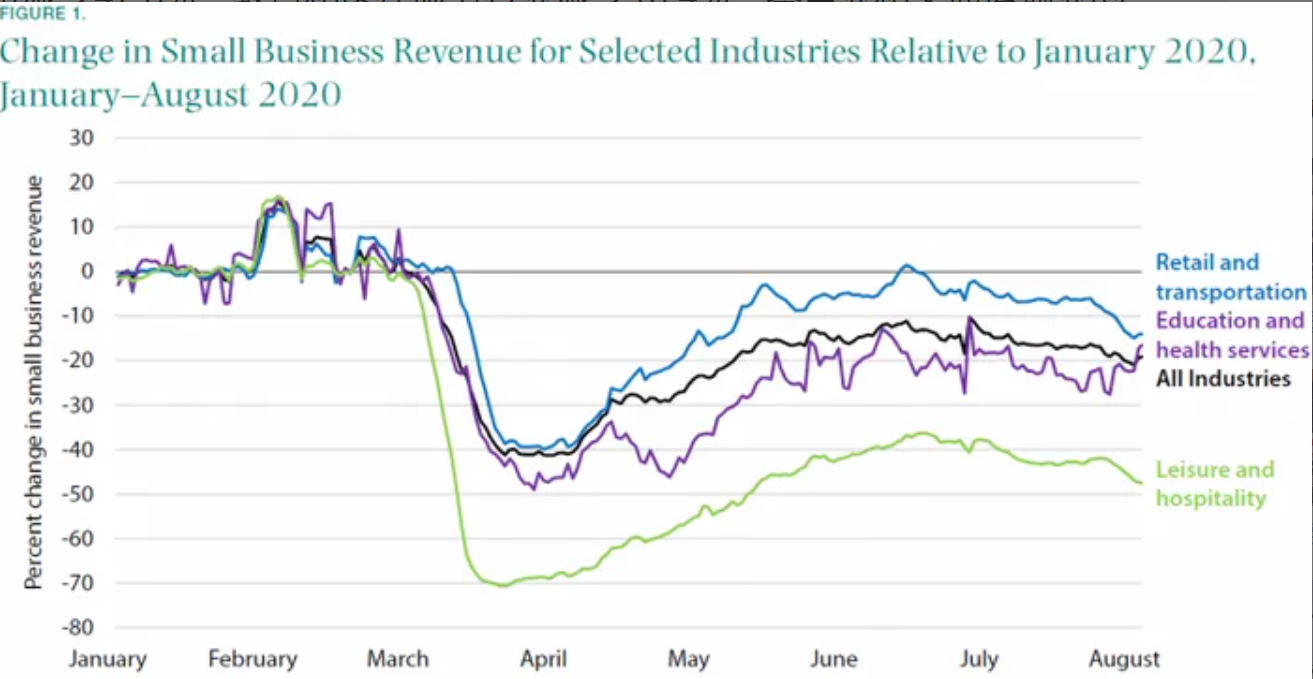

Small businesses in the entertainment, hotel, tourism, education, and medical service industries have experienced a particularly serious decline in income. As of August 9, the average daily income of the entertainment, hotel, and tourism industries decreased by 47.5% from January, the education and medical services industries decreased by 16.4%, and the retail and transportation industries decreased by 14.1%. Across all industries, the overall income of small businesses fell by 19.1%.

Those industries that are unable to work remotely and are deemed unnecessary during the epidemic are in the most difficult situation. It is worth noting that after experiencing the initial rebound, starting in August, the income of some industries has fallen again. In the first ten days of August, the revenue of retail, transportation, entertainment, hotel and tourism all fell by more than 5%.

2: The number of bankruptcies and reorganizations exceeds the previous year

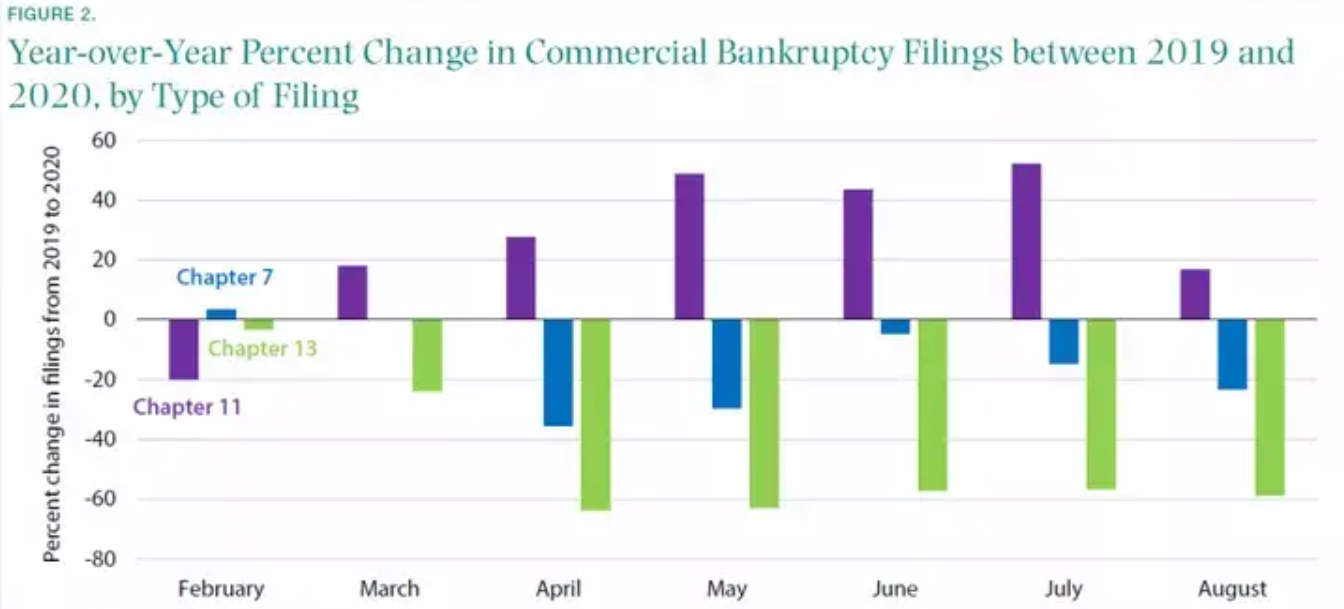

The decline in revenue caused a large number of companies to go bankrupt. According to estimates by the Brookings Institution, from the beginning of the outbreak to the end of July, nearly 420,000 small businesses went bankrupt. Under normal circumstances, it will take a year to reach this level. However, the total number of bankrupt companies from January to August decreased by 27% from the same period last year.

The number of companies that filed for bankruptcy in accordance with Chapter 11 of the US “Bankruptcy Law” declined in February. But since March, the number of such bankruptcies has been higher than the same period of the previous year every month, with an increase ranging from 15% to 50%. Larger companies can apply for such bankruptcy to achieve business reorganization, but many small companies often choose to close their doors directly.

3: The downward trend of startups has been completely reversed

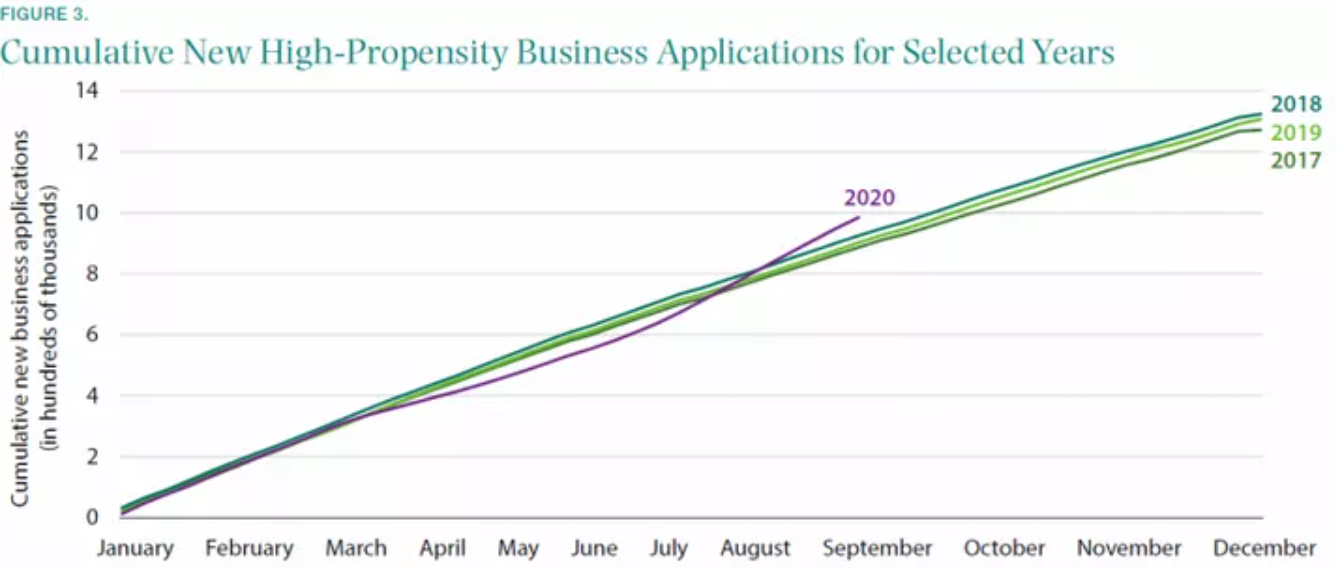

This spring, the number of business closures increased sharply. At the same time, the number of new companies established at the beginning of the epidemic was also lower than the level before the epidemic. But recently, the number of startups has started to pick up.

As of the beginning of June this year, such applications had decreased by 4.4% compared with the same period last year, but by mid-August, the situation had been completely reversed, and the number of applications had actually increased by 56% over the same period last year.

During an economic recession, start-ups tend to decline. In the current recession, the public health situation will further affect the creation of new companies. For example, in states with more deaths from the epidemic, the number of applications from companies is usually smaller.

Since the beginning of the summer, the number of applications for new company formation has rebounded. In this regard, the policy research agency EIG has given three possible explanations:

- The large number of applications that had been accumulated during the epidemic were released in a short period of time;

- Some of the unemployed recently may start their own businesses;

- Some entrepreneurs hope Use the redistribution of resources caused by the crisis to create new businesses or seize other business opportunities that appear in the market.

4: Reduction of total working hours caused by layoffs and business closures

In the modern history of the United States, the damage to the labor market caused by the epidemic is unprecedented in history, no matter in terms of speed and degree. In the face of the epidemic, many companies have reduced their working hours.

The total working hours fell by as much as 60% in March; since mid-April, the total working hours began to rise and stabilized since June. Since then, the total work-hour decline has remained between 25% and 30% of the reference time period.

Starting from the end of March, the main reasons for the decline in total working hours are layoffs and business closures. In other words, the reason for the reduction in working hours is not the shortening of actual working hours, but because of the decline in the employment rate and temporary unemployment. By the same token, working hours began to rise after bottoming out at the end of April, mainly because workers returned to work. The resumption of work in enterprises, especially in small enterprises, has been an important driver of the increase in employment since April.

5: More permanent unemployment

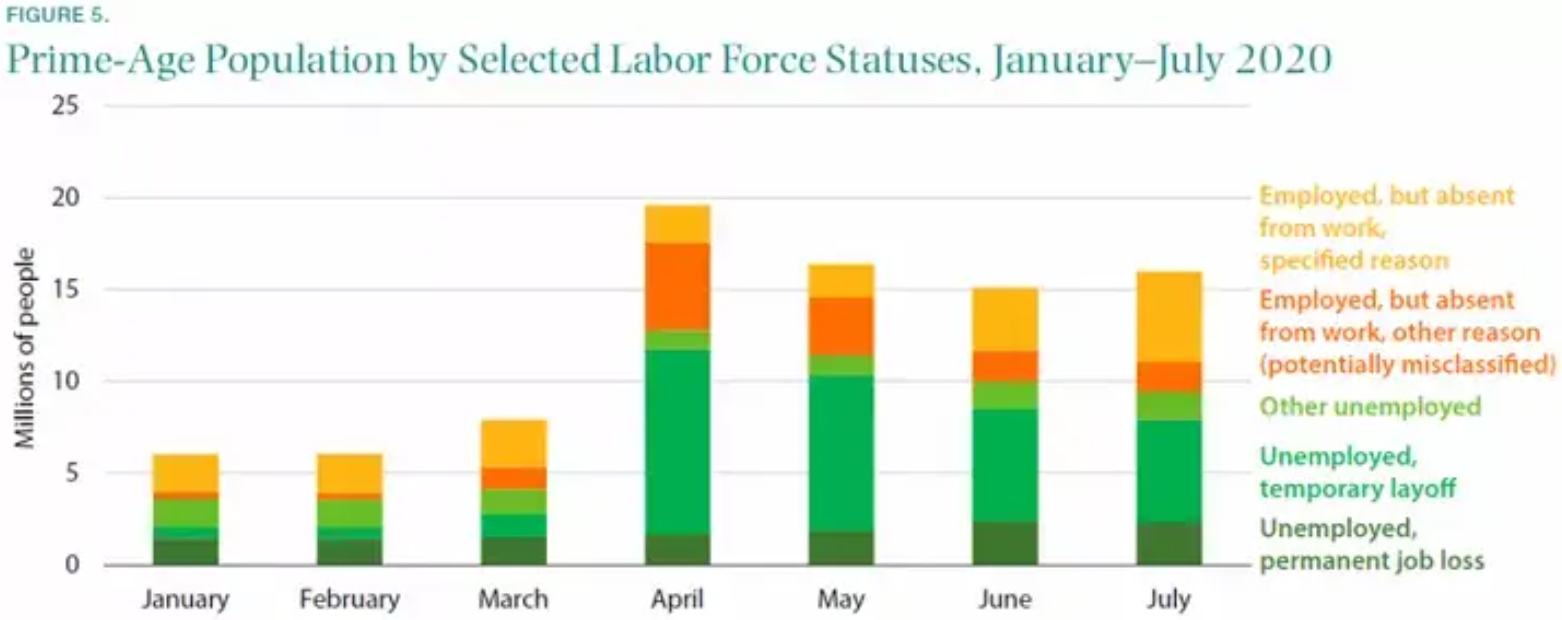

During the economic downturn, the proportion of employed population in the total population tends to decline. In April, the labor force of the right age who was temporarily unemployed, or who was not unemployed but was temporarily unemployed due to suspension of pay and other reasons, rose from 7.9 million in March to 19.6 million. This was mainly due to a 10.3 percentage point increase in the unemployment rate in April.

At the beginning of the recession, most people who did not go to work, whether they were truly unemployed or those who were not unemployed but did not go to work, described this state as a temporary state. Compared with permanent unemployment, temporary unemployment has less impact, because once the employment relationship is restored, such people are much more likely to return to work. In April, the temporarily unemployed population was 10.1 million, and 4.8 million people may be mistakenly classified as employed population. However, these people did not work due to various reasons. Another 2 million people have jobs, but due to some The specific reason did not go to work. In general, these three groups accounted for 86.3% of the unemployed working population in April.

The increase in permanent unemployment means that more people will be unemployed for a longer period of time. By February 2021, 4.5 million people will be unemployed for more than 26 weeks, and nearly 2 million people will be unemployed for more than 46 weeks. The extension of the unemployment period will lead to a decline in future income, and will also depress the home ownership rate.

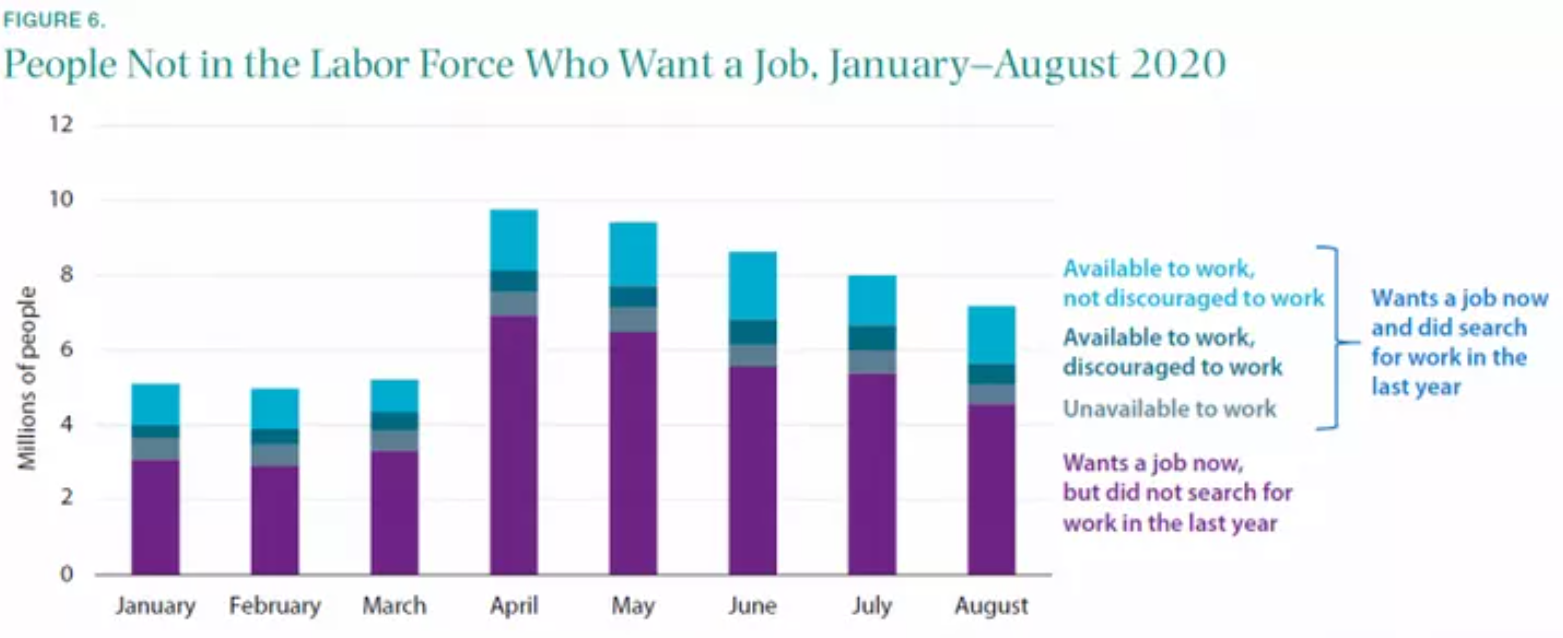

6: The unemployed population willing to seek jobs continues to rise

Among the unemployed who have the willingness to seek jobs, 6% are pessimistic about the prospects of the job market. In addition to being pessimistic about employment prospects, 16.7% of people said that they did not look for a job for other reasons. Between March and April, the increase in the unemployed population willing to seek jobs was particularly evident among young and middle-aged people aged 25-54, with an increase of 2.5 million. Since April, this part of the population has been rising. The unemployment rate in the United States in August was 8.4%. However, if another statistical caliber is adopted, all unemployed people who are willing and not willing to seek jobs will be counted. The unemployment rate in August will rise to 9.6%.

Among the unemployed people who are willing to apply for a job, many people are delayed in finding a job for other reasons, including taking care of their children, commuting problems, illnesses, and so on. The number of this group has been increasing steadily, rising from 867,000 in March to 1.8 million in June. In August, this part of the population dropped slightly to 1.5 million. Due to the need to take care of their children, many working parents are forced to withdraw from the labor force. This trend may have a long-term negative impact on the job market in the coming years. However, from the current point of view, the government has not yet adopted a large-scale policy intervention on this issue.

As before the epidemic, most of the unemployed who withdrew from the labor force did not have the will to seek jobs. Approximately 90 million Americans say that they do not want to work. This group mainly includes students, family caregivers, retirees and sick people, and their number further increased between April and May. There are signs that the epidemic has even prompted some people just over 54 to retire early. For example, 28% of those who still had jobs in January but had withdrawn from the labor force in April said that they stopped seeking jobs because they chose to retire.

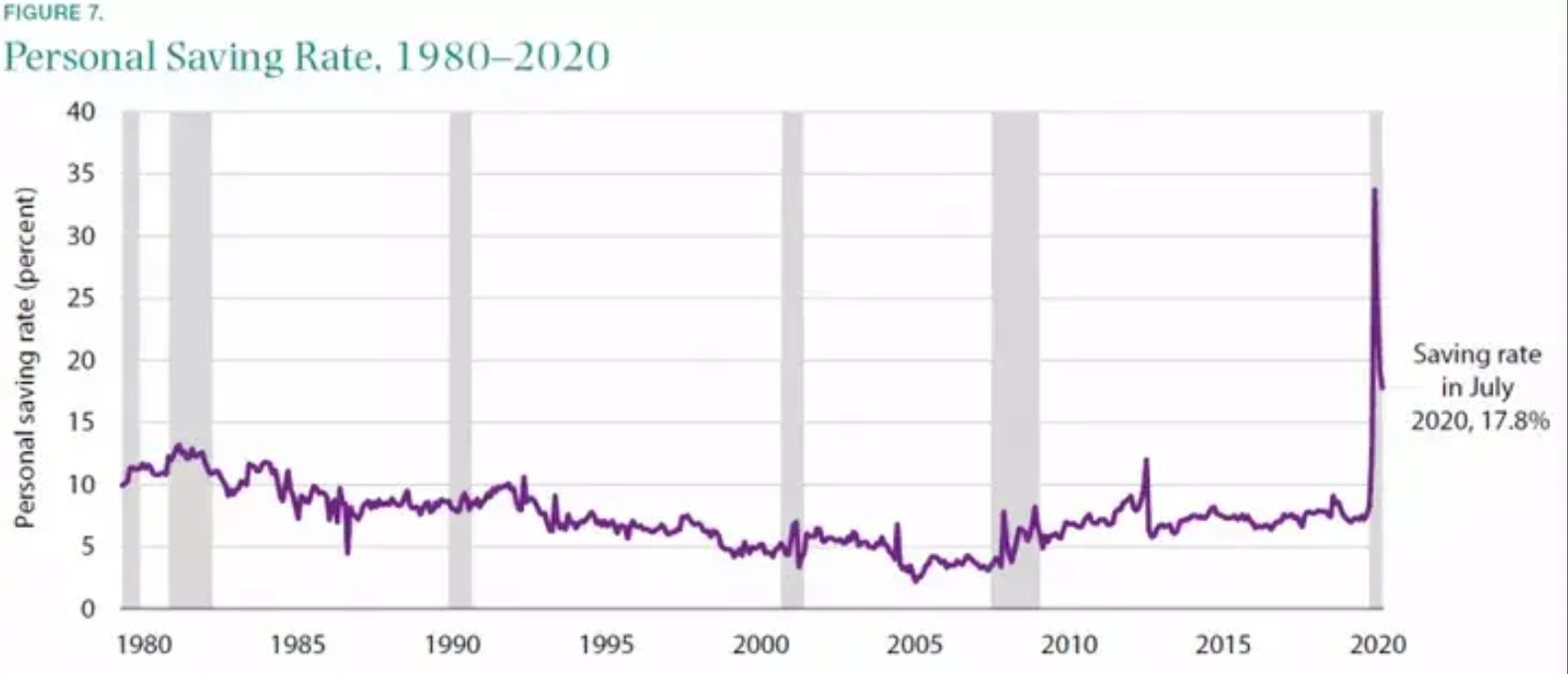

7: Personal savings rate reached the highest in history in April

One of the most direct effects of the epidemic is that overall consumption has plummeted, but the savings rate has risen sharply. The personal savings rate peaked at 34% in April, which is also the highest level in history. Although it has declined since then, it is still at a high level. The increase in the savings rate is the result of a combination of reduced spending and increased federal transfer payments.

Like the rest of the world, consumer spending in the United States also fell after the economic shutdown caused by the epidemic. At the beginning of the outbreak, the consumption of many goods and services declined, but the consumption of some goods rose instead of falling. And since March, consumption of most commodities has rebounded. For example, the consumption of daily necessities was very strong at the beginning of the epidemic, because women and families with children and elderly people hoarded a large amount of supplies. Although commodity consumption has rebounded to the level before the epidemic, as of the end of July, service consumption still rebounded weakly.

Driven by unemployment insurance benefits and other forms of federal transfer payments, the savings rate has been on an upward trend as of July. Affected by this, although tens of millions of people are unemployed, personal disposable income from March to July still exceeded the level before the epidemic.

Although there are signs that many low-income families quickly spent government assistance funds, other income groups still expressed their willingness to save, and compared with the past, low-income families are more willing to deposit all their monthly income in the bank. In addition, in many families receiving federal assistance, the balance of current assets has increased significantly. This phenomenon shows that early stimulus and insurance programs have played an important role in mitigating the impact of the decline in the job market on household finances. But for low-income families who have failed to receive federal assistance, the economic situation is not optimistic.

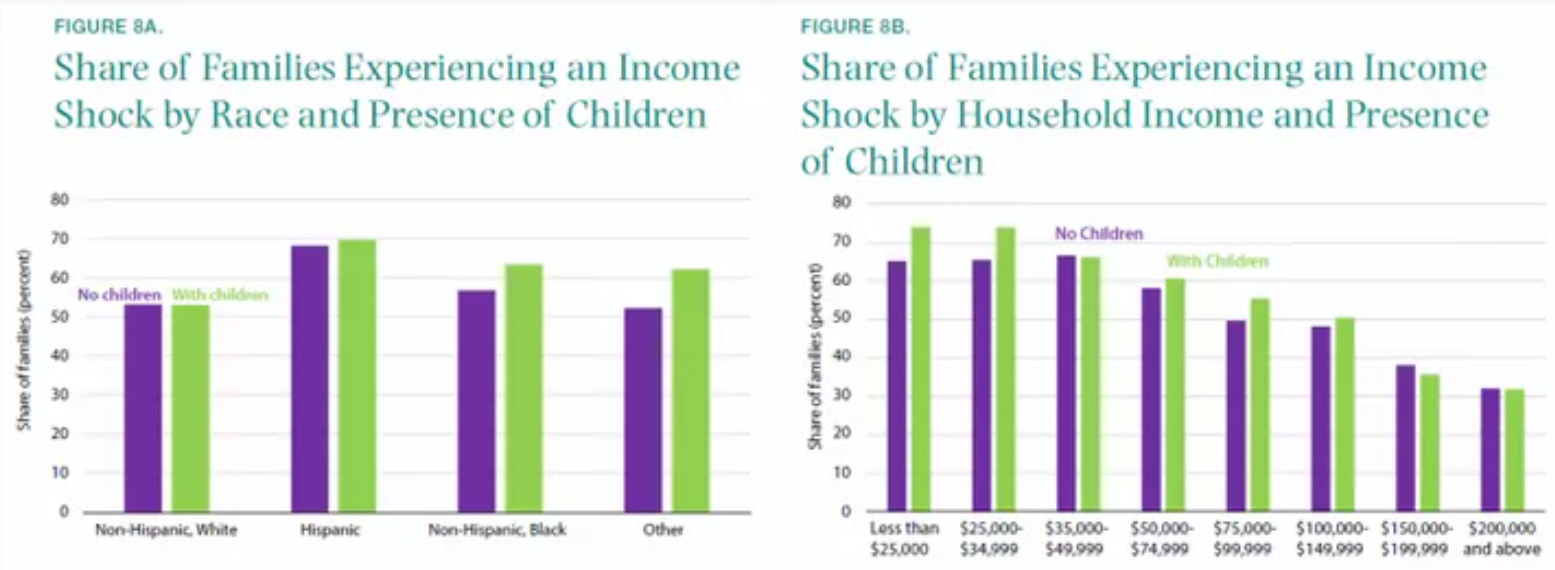

8: Low-income families have a high probability of income decline

In the recession triggered by this epidemic, unemployment and income decline have been different among different groups. Since March, low-income families, non-white families, and families that need to raise children have the highest probability of experiencing income decline.

In recent times, about half of African and Hispanic families have experienced income declines. Among them, Hispanic families are most likely to suffer a decline in income, regardless of whether they have children. In April, 61% of Hispanic adults said they or their relatives had experienced unemployment or income decline. From the perspective of ethnic differences, after analyzing the smooth consumption after income decline (that is, maintaining a stable consumption level amidst economic cyclical changes and income fluctuations), it is found that after the income decline, African-American households cut consumer spending more than It is 50% higher in white households and 20% higher in Hispanic households.

More than three-fifths of low-income families with children said that after the outbreak, they experienced the impact of a decline in income. After the epidemic reduced income, a series of life difficulties appeared, including the inability to obtain food and the inability to pay various bills. Families with children are particularly susceptible to debt default: for every additional child, the probability of a serious default (at least two months of delay in repayment) increases by 17%.

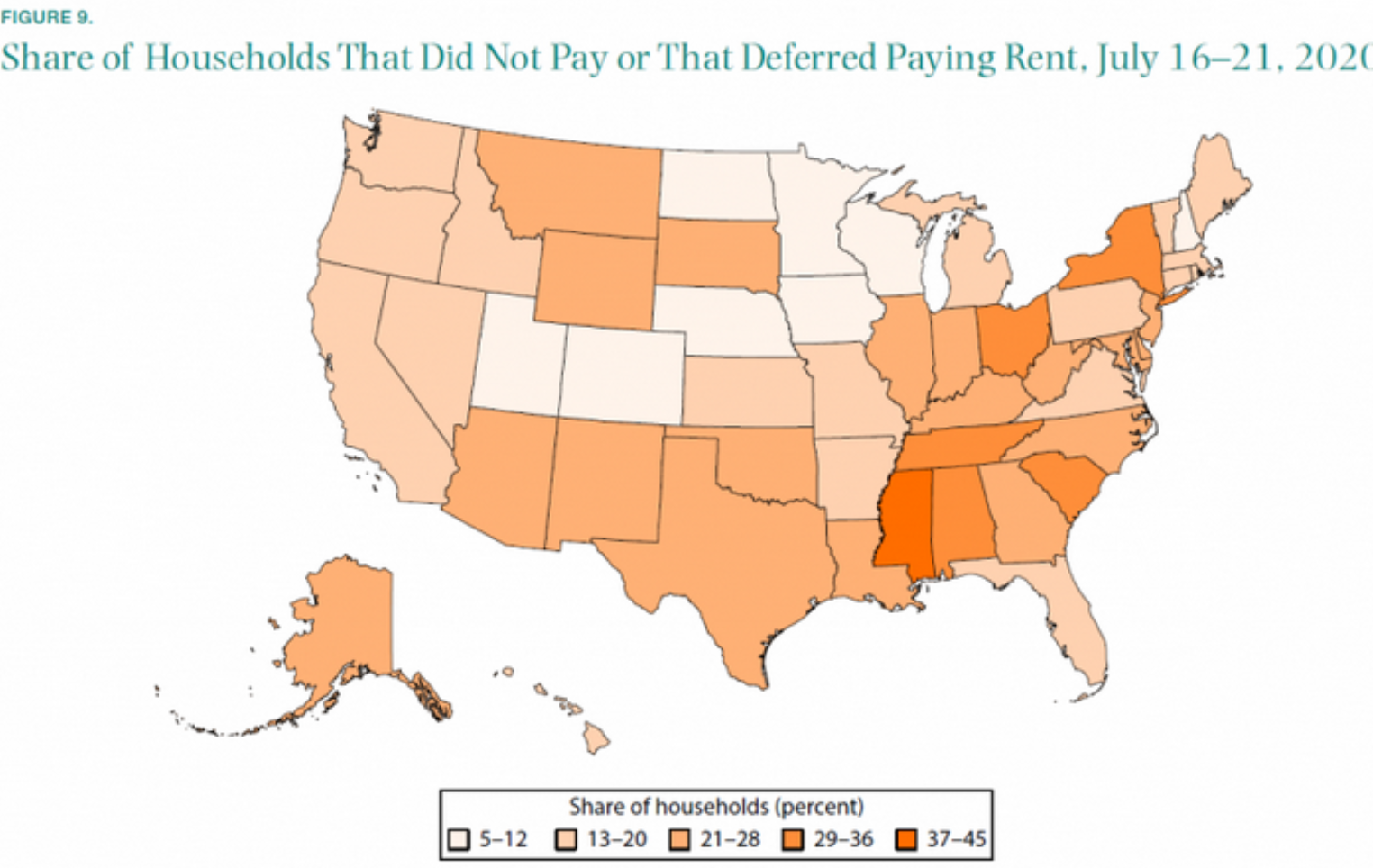

9: 20% of households in July defaulted on rent

Although the government provides considerable relief and benefits to families and unemployed workers, it still cannot solve all the problems of families in need. A survey of housing tenants conducted at the end of July shows that in 26 states in the United States, more than one-fifth of household tenants have not paid the rent for June. In five states including New York Among them, the proportion of tenants who did not pay the rent in June on time was as high as one-third.

According to a survey conducted by the rental platform Apartment List, rent arrears are mainly concentrated among young people, low-income families, and residents living in densely populated cities. Once there is a delay in rent payment, the possibility of rent arrears next month will increase, which will trigger a vicious circle, and the landlord may also take back the house. In addition, compared with homeowners, tenants are less likely to receive federal housing subsidies.

For many unemployed families, their current assets on hand are less than two months of income, and the ratio of debt to income remains high. A survey conducted by the Pew Research Center in April showed that 73% of African-American adults 70% of Hispanic adults said that their emergency funds were not enough to cover three months of living expenses, compared with 47% of whites. In addition, the African-American and Hispanic respondents also said that even through borrowing, using savings and even selling assets, they still cannot afford three months of living expenses.

10: Family food insecurity rate has doubled

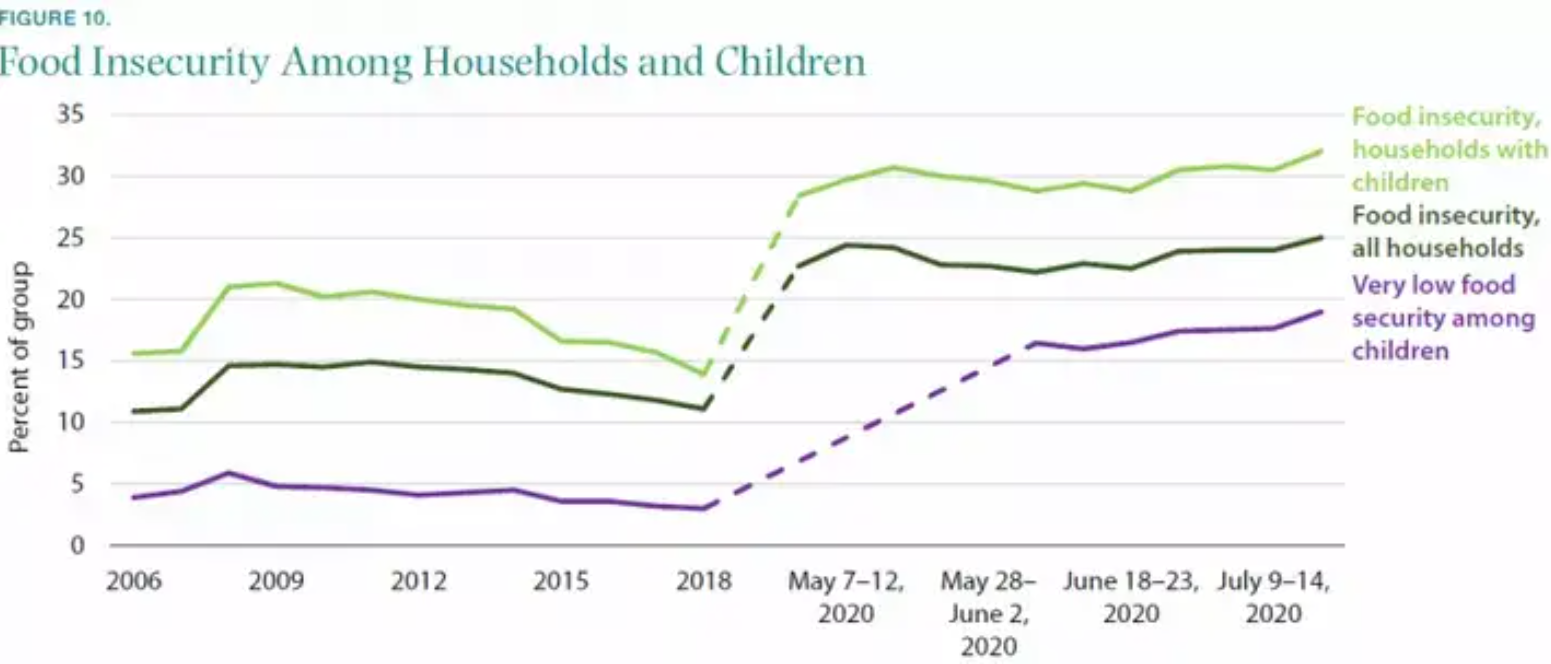

During the epidemic, the food insecurity rate and low security rate of families with children increased. The so-called food insecurity means that a family lacks sufficient food to ensure the health and vitality of family members, and lacks resources to obtain more food. Low security is similar to hunger, which refers to a major or continuous interruption in household food consumption. One point that cannot be ignored is that the current food insecurity rate has exceeded the highest level during the 2008 global financial crisis.

The food insecurity rate of families with children is particularly high. In fact, before the outbreak of the epidemic, the food insecurity rate of families with children was already on the rise. In 2018, such families accounted for approximately 14% of all households, and by July 2020, this proportion Rose to about 32%. For African-American and Hispanic families, as well as those with children, the above ratio is even higher.

Generally speaking, even in the event of food insecurity, families can still meet the food needs of their children, but this is not the case today. Between June and July, the number of children with extremely low food security rates increased. By the third week of July, the proportion of these children had risen from 16.4% in the first week of June to 19%.

Fortunately, some epidemic response measures have alleviated the food shortage problem. The disaster response project Pandemic EBT distributes supermarket shopping vouchers to eligible families to compensate for school meals lost due to suspension of classes. In this way, the proportion of children with extremely low food security rates has been reduced by 30%. In addition, unemployment insurance benefits and emergency food assistance provided by the US Nutrition Supplementary Assistance Program (SNAP) have also reduced the food insecurity rate to a certain extent.

Conclusion

It is a long hard time for most Americans, and the Governments as well. However, with scientists’ research on drugs and vaccines, it is believed that the new crown epidemic will soon be controlled globally in the near future.